georgia film tax credit history

GEORGIA FILM TAX CREDIT FUND LLC was registered on Feb 23 2012 as a domestic limited liability company type with the address 3333 Piedmont Road Suite 2500 Atlanta GA 30305. With one of the industrys most competitive production incentive programs the Georgia Film.

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

To calculate your tax credit simply multiply your qualified Georgia expenditures by 20.

. Film Tax Credit Reporting. For example for a base investment in Georgia of 20000000 your savings would be 4000000. An additional 10 tax credit was awarded to.

On August 4 2020 Governor Kemp signed into law HB. Production companies generate the credit by spending money in Georgia on production activities. That challenges an earlier finding from the state that the film industry had a 95 billion impact on the states economy in 2018.

Georgia production incentives provide up to 30 of your Georgia production expenditures in transferable tax credits. That figure is 40 higher than the states previous record 860 million set in 2019 as liberal loans fuel the industrys exponential growth. Projects certified on or after January 1 2023 are required to have a final tax certificate in order to use.

EUE Screen Gems offers a 6 decade history of making film television and also commercial projects of the best quality. Film Tax Credit Electronic IT-TRANS Submission Inside of a GTC Login. It also represents a significant rebound from 2020 when credit dropped to.

The act granted qualified productions a transferable income tax credit of 20 of all in-state costs for film and television investments of 500000 or more. Explanation of the New Film Tax Credit Reporting and IT-TRANS Process. The entitys status is Active now.

A final tax certification is not required before January 1 2023 for productions seeking a 25M credit. For example an individual purchases 1000 of Georgia film credits and had a 600 Georgia income tax liability for the year and had 500 Georgia withholding from their wages. As of March 2019 there were more than 17 billion in outstanding credits.

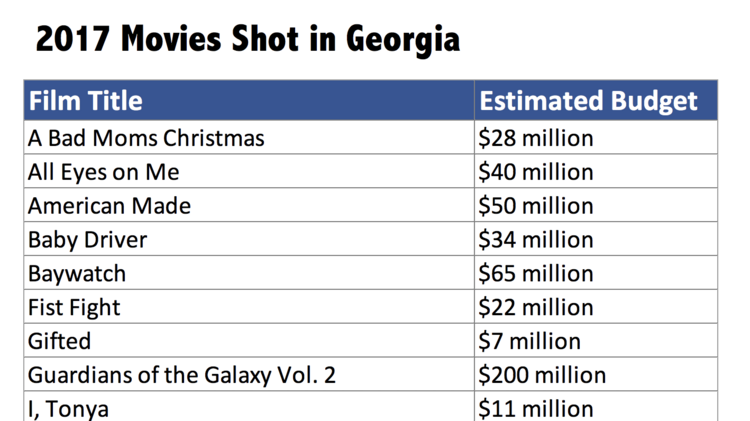

The company id for this entity is 12016630. In terms of tax credits the cost per film job is between 64000 full-time and part-time and 119000 FTE per job. The mandatory film tax credit audit is based on the date the production was first certified by the Department of Economic Development DECD and the credit amount according to the following schedule.

The state review in January which preceded reforms found the tax. A tax certification is not required before January 1 2023 for credits of less than 125M. They get an additional 10 for providing that cool Georgia Peach logo at the end of the.

Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia. An additional 10 credit can be obtained if the finished project. For example for a base investment in Georgia of 20000000 your savings would be 4000000.

1 The new law appears to be in response to an audit report issued by the Department of Audits. Television films pilots or series. The credit would offset the Georgia liability of 600 while 400 of the credit would carry forward to.

Georgia Last year it contributed a record 12 billion in film and TV tax credits more than any other state in incentives. 1037 which enacts significant procedural changes to the states film tax credit allowed pursuant to OCGA. Payments made to a loan-out company will require 6 percent Georgia income tax withholding.

As they may often not have income tax liabilities of their own these companies sell the credits to brokers who then resell them to Georgia taxpayers at a discount. If you include the GEP Uplift in the finished project your credit would be at the 30 level or 20000000 x 30 6000000 in Georgia tax credit. Georgia Film Tax Credits were created to entice production companies to come to Georgia and spend their money on movies films commercials etc.

While the use of tax incentives to encourage US. Georgias entertainment tax credit GEIIA passed in 2005 is already one of the most successful business incentive programs at the state level and a clear contributor to Georgias rise to stardom as a formidable competitor in the film industry on and off the big screen. Withheld shall be deemed to have been withheld by the loan-out company on wages paid to its employees.

Georgia film credits in excess of a buyers liability may be carried forward for five years. Film and television production has gained momentum. If you include the GEP Uplift in the finished project your credit would be at the 30 level or 20000000 x 30 6000000 in Georgia tax credit.

Development costs promotion marketing story rights and most fees do not qualify. The 800 million in tax credits approved in 2018 represents a cost of 3 percent of Georgias state -funded budget or 220 per Georgia household. The agent name for this entity is.

Although Georgia provides an incredible Georgia film tax credit the pairing of both the state of Georgia and EUE Screen Gems makes for top quality productions with a low bearing cost making the 2 a great deal found nowhere else. Heres how Film Tax Credits work. Tax The Georgia film credit can offset Georgia state income tax.

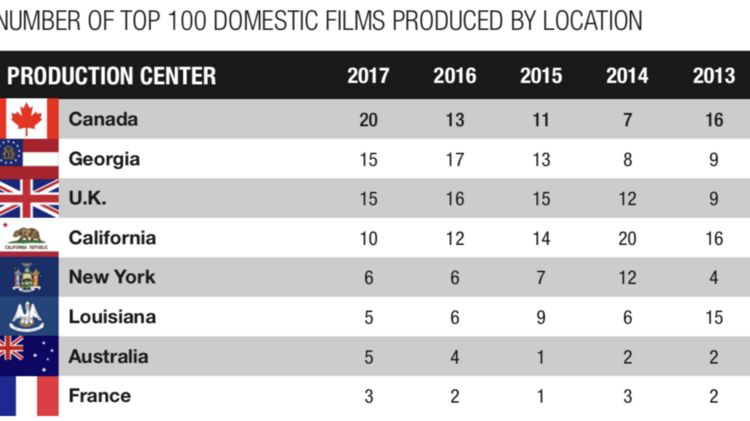

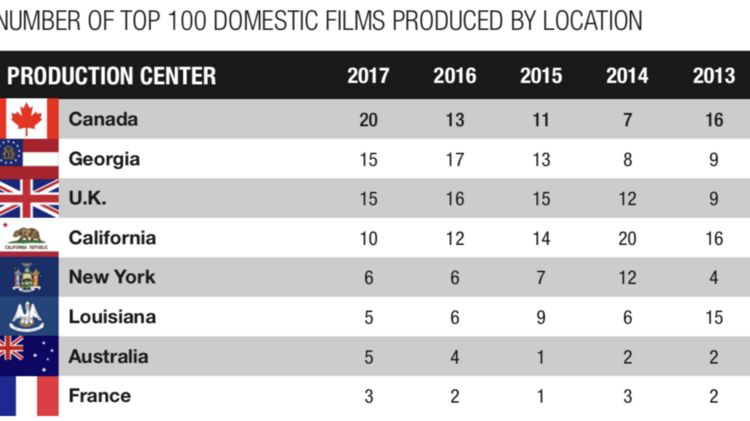

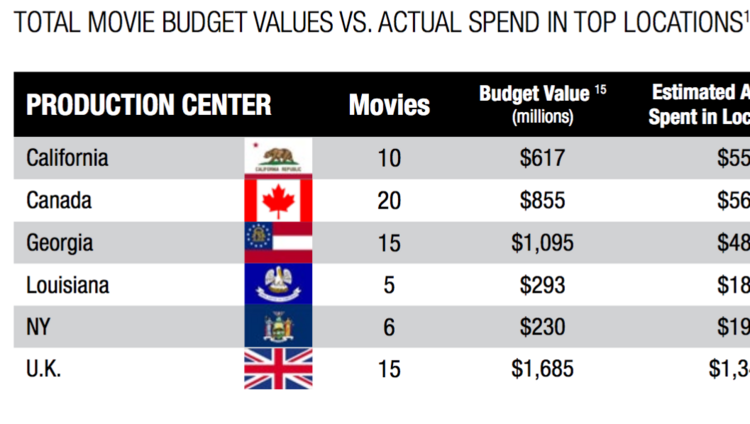

For services performed in Georgia. Consequently the credit grew from approximately 407 million in 2013 to 915 million in 2017 an increase of 125 in four years. Projects first certified by DECD on or after 1121 with.

Film Tax Credit Certified Eligible Auditors Film Tax Audit Procedures Manual. Beginning January 1 2021 mandatory film tax credit audits must be conducted before usage of the film tax credit. Companies for services performed in Georgia when getting the Georgia Film Tax Credit.

Verification of In-State Work Excel GL Audit Template Excel How-to Directions for Film Tax Credit. Georgia does not cap the film tax credit for most companies1neither the total amount granted nor the amount an individual project can receive. There is a tiered system that is based on the estimated tax credit value.

Georgia Enacts Significant Procedural Changes to the Film Tax Credit. The states second and most progressive tax incentive the Georgia Entertainment Industry Investment Act was signed into law in May 2005 and updated in May 2008. Film Tax Credit Electronic IT.

To calculate your tax credit simply multiply your qualified Georgia expenditures by 20. Includes a promotional logo provided by the state. The way it works is that production companies get a 20 credit on what they spend for certain expenses while making their project.

Post-production of Georgia-filmed movies and television projects qualifies if post done in Georgia. Production companies are required to withhold 6 Georgia income tax on all payments to loan-out. This discount represents the savings to a particular taxpayer.

Georgia has approved over 4 billion in tax credits in the past decade. The program is available for qualifying projects including feature films television series commercials music videos animation and game development.

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Georgia Film Industry Posts Record Year After Blow Dealt By Covid

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Scrap Bill That Would Have Capped Its 900 Million Film Incentives Deadline

Celebrating The Georgia Film Industry Stranger Things Filming Locations Georgia Georgia On My Mind

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

The Bowery Went Down To Georgia Georgia Film Savannah Chat

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Film Tax Credit Could Be Capped Amid Fiscal Crisis Variety

Georgia Film Records Blockbuster Year Georgia Department Of Economic Development